President Biden announced his upcoming plan to forgive student debt for low and middle-class loan borrowers Aug. 24. In his three-part plan, Biden sticks to the promise he made during his way into office, which was to cancel $10,000 worth of student debt per borrower.

“Today, my Administration is meeting my campaign commitment with targeted debt relief to folks from families who need it most,” Biden said in a tweet last week. “If you received a Pell Grant while in college and make less than $125,000 a year, you are eligible for up to $20,000 in debt reduction.”

This new federal plan serves as a solution to middle-class borrowers who studied in college but had to take out loans. While this new program has left many with a feeling of relief, some think of the decision as unfair.

“I mean, it’s all kinds of good things for the rest of students who took a lot of loans because a lot of current students really need the loan forgiveness,” said Soochan Choi, assistant instructor for marketing, management, and supply Cchain at UTEP. “But sometimes there’s another side effect, such as it (can look) unfair for someone who didn’t get the forgiveness [who] would need it. For example, (maybe) they get supported by their parents or they get a scholarship. Maybe it sounds unfair because they cannot get the student loan forgiveness, but in general, I think it is needed because a lot of people need (it).”

Though it has been only a week since the announcement, it seems as though people have already started an opposition campaign toward the plan. GOP lawmakers from states like Arizona and Texas have already declared that they would file lawsuits disputing the policy. Prominent political figures like Texas Sen. Ted Cruz have already spoken out against Biden’s plan and have consulted multiple courts across the country.

While certain political figures argue against the policy, there are some students who have already aligned with and accepted the idea.

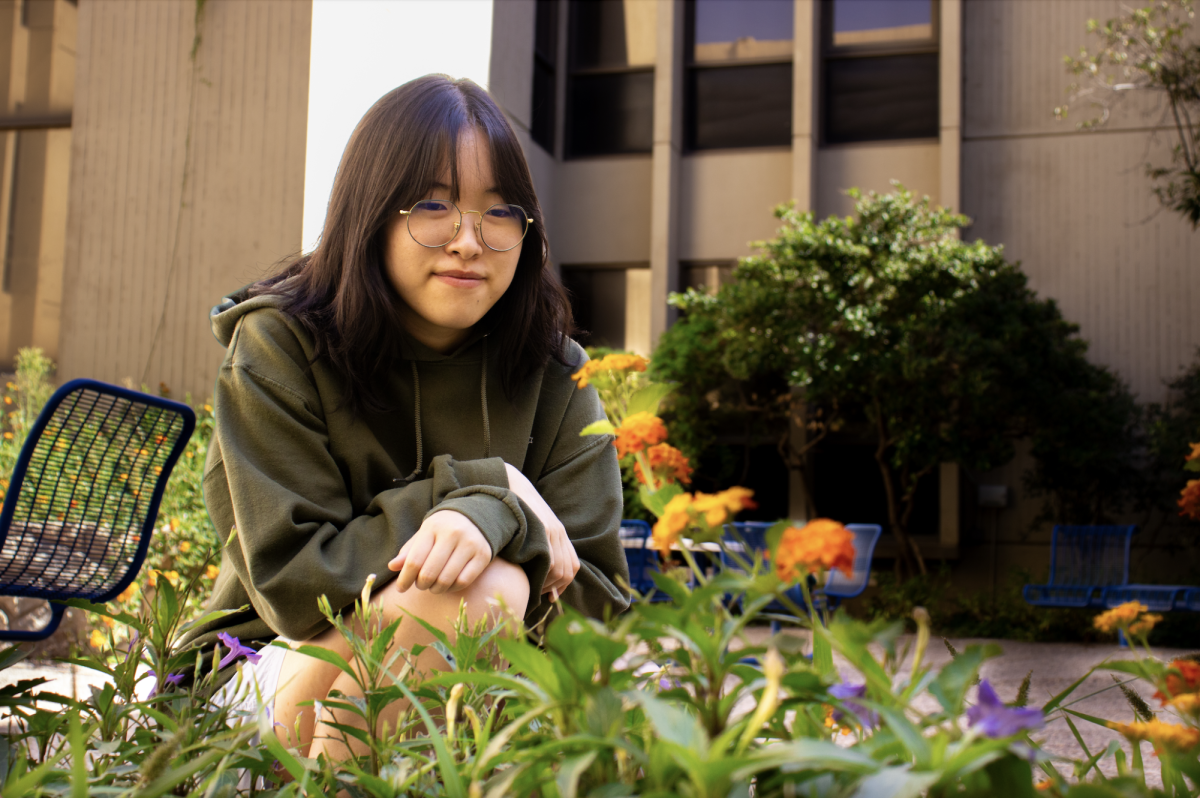

,“I’m not opposed to it. I think it’s something that definitely is very helpful, especially for students who might not have the means to pay for their loans,” said Andrea Sandoval, a psychology major at UTEP.

Not only does this new policy mean aid for undergraduate students who have already racked up student loans, but it can also help scholars who have had to pay back loans for their master’s degrees.

“In psychology, that’s a lot of people’s goals, to either get a masters or Ph.D.,” Sandoval said. “When you’re already doing your undergrad and developing a lot of that debt, I mean, that’s definitely where it becomes helpful.”

While many students and lawmakers alike have voiced their opinions over Biden’s new plan on social media, there will certainly be more talk regarding the project as moves from all sides unfold.

Elisha Nuñez is a staff reporter and may be reached at [email protected].