WASHINGTON – After years of departmental pressure and legislative meetings, one of the nation’s reddest rectangles approved a tax increase.

Wyoming, a state with 914 miles of interstate and fewer than 600,000 people, increased its state’s gas tax by a dime, to 24.4 cents – effective July 1.

“It was a very vigorous discussion,” John Cox, director of the Wyoming Department of Transportation, said describing the tax talks that lasted nine legislative sessions.

When legislators saw the numbers, Cox said, they compromised to improve and fund the state’s infrastructure.

Nearly two-thirds of funding for Wyoming’s roads comes from the federal government’s Highway Trust Fund.

Unless Congress finds a way to fund the program before the August recess, the nation’s roads will remain in a state of disrepair. The House and Senate committees that oversee federal transportation spending are expected to hold hearings sometime this month.

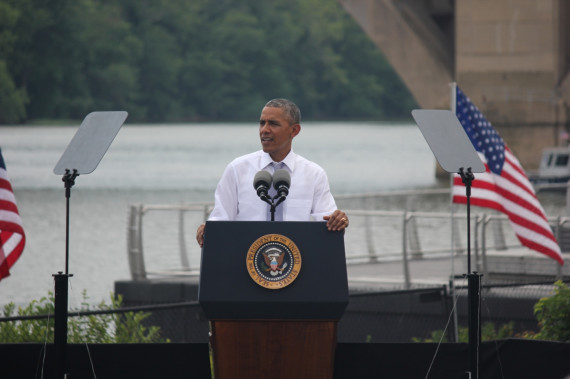

“This is a crisis that can be avoided,” Transportation Secretary Anthony Foxx said July 1.

Exactly what projects will be affected in Wyoming depends on state politics and whatever funds are available.

“It will be like when you need $50, but you only have $10,” Cox said.

So, what happens if the Highway Trust Fund isn’t funded?

Foxx outlined the plan in letters to state departments of transportation. The DOT will limit its own spending and begin to dole out what is left based on each state’s federal allocation every two weeks until nothing is left. The amount each state gets is determined by Congress.

“We believe this is the most equitable and prudent approach,” Foxx said.

DOT’s “cliff” is the $4 billion mark, which the Trust Fund is likely to hit in August. Roughly a month later, there will be nothing left.

How badly each state will feel without funds varies. Transportation for America data indicate Rhode Island will be hit the hardest because nearly all of its funds for highways come from the federal government, compared to Utah, which uses a little more than a third.

If Congress is able to find a way to fund the program until Dec. 31, it would cost $6.6 billion, according to a June 27 report from the Congressional Budget Office. The number also assumes $1.5 billion would be raised from the federal gas tax.

State governments will then determine what projects, if any, can go forward with the money they have.

“It’s already had a chilling effect,” Meghan Keck, Department of Transportation communications director, said.

Many projects can take years to complete, and without the certainty of funding, states may choose not to pursue them. Keck said she hopes Congress is able to find a long-term solution for funding transportation projects, because doing so could help create more jobs.

Ideas to solve the problem haven’t received any traction in Congress.

DOT’s legislation, known as the GROW America act, would fund the nation’s roads for four years by altering the tax code.

In June, Sens. Chris Murphy, D-Conn., and Bob Corker, R-Tenn., offered a plan to increase gas taxes to pay for the shortfall, but the Obama administration and many Republicans oppose any plan to increase taxes. On the House side, Rep. Earl Blumenauer, D-Ore., proposed a 15-cent bump in the federal gas

tax in December.

The gas tax was last raised in 1993 – it is 18.4 cents per gallon.

That’s why Kentucky, Maine and New Hampshire joined Wyoming to increase their state gas taxes on July 1.

Foxx reiterated the administration’s position on gas taxes at last week’s Christian Science Monitor Breakfast, saying that the administration opposes it unless that’s the bill that ends up on Obama’s desk.

“As a country, we have to stop playing small ball with transportation,” Foxx said.

Thanks to a reserve fund that could help Wyoming’s transportation fund in the short-term, Cox said the state will not feel the pinch until the next contracting season.

Because of the state’s conservatism, Cox said many Wyomingites would rather use state funding to maintain the roads.

“Some people say the strings that come with federal funds are hard to put up with,” Cox said. “But you just can’t not use federal funds with highway construction.”

Daniel Wheaton may be reached at [email protected] or 202-236-9871.