UTEP students are putting a halt to big life decisions as they work their way through an increase of debt and the economic downturn, but many remain optimistic about their ability to repay their loans.

The amount of student loans taken out by UTEP students have increased by 25 percent from 2009 to 2013, according to Craig Westman, associate vice president at Enrollment Services Management.

“This is good,” Westman said. “We encourage students to take out loans so they can graduate early and have income potential.”

President Barack Obama signed the Student Loan Interest Rate Deal Aug. 9, which put a cap on loan interest rates at 8.25 percent. But these changes will not take affect until 2014.

During the same time period, the amount of grants given to UTEP students increased to 30 percent, tuition exemptions went up by 70 percent, on-campus student employment went up 26 percent and the amount of scholarships given increased by 35 percent.

With an estimated $1 trillion in student loan debt, young Americans are finding it harder to move on from student loans and purchase houses, cars and other big-ticket items. Many are also stalling major life decisions such as getting married or starting a family.

Sophomore psychology major Carlos Padilla said he will not be living the same lifestyle as his parents because of his growing debt and his future debt, as he plans to attend medical school.

“I don’t think I could afford any big purchases due to my plan on attending a medical school–that is really expensive, especially since the college I want to attend will be out of state. I predict a lot of debt after graduation,” Padilla said.

UTEP offers a number of resources when paying for school. For example, the EasyPay Plan, which allows a student to pay their tuition throughout the semester, and the Guaranteed Tuition Plan, which guarantees that tuition and fees will remain low as long as the student graduates within four years.

“The big thing is to help students do other things instead of taking out loans, such as the Stafford Loans—which are run by the government—first and the interest rates are lower for those too,” Westman said. “Taking out private loans with the bank should be last.”

Through these payment plans, a student who has $10,000 worth of loans could pay $100 a month or less instead of $400 they would pay from a private loan.

Getting a private loan results in a fixed amount that the student has to pay back. By setting up a repayment plan, students can avoid this and not stress about making a certain income the day after graduation.

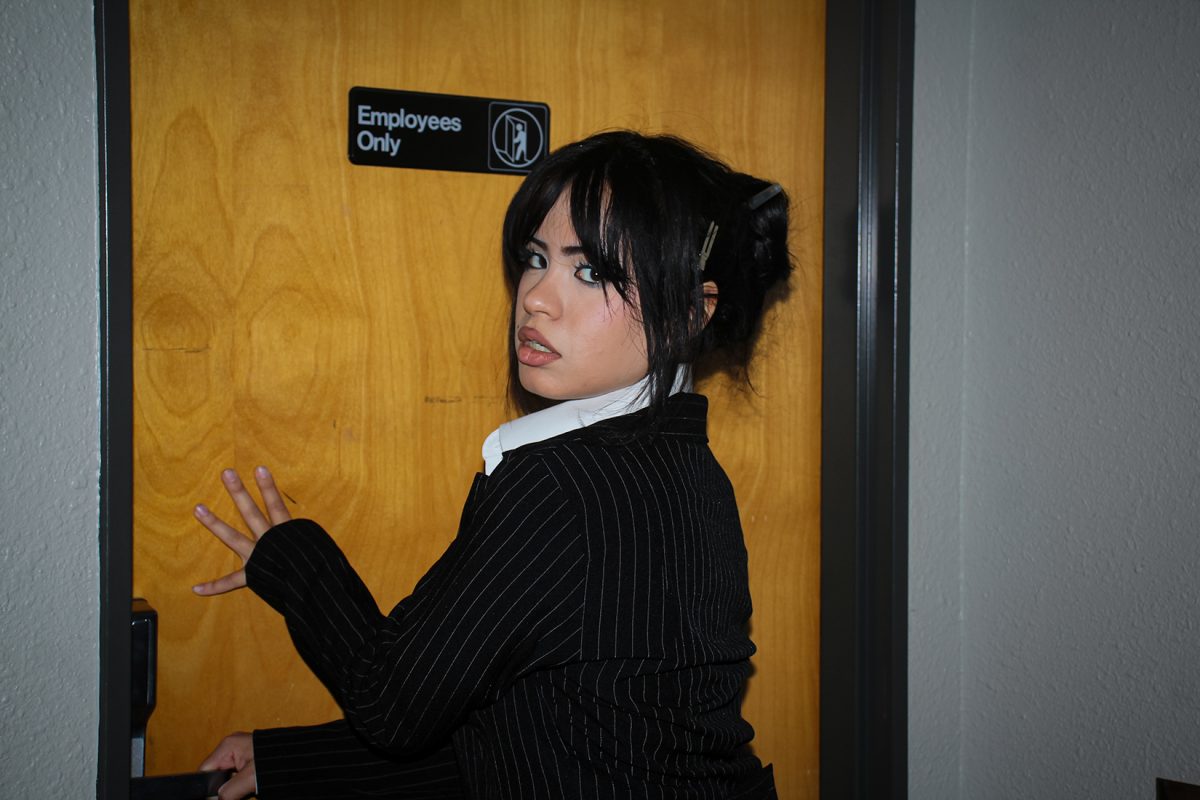

Jacqueline Aranas, graduate special education major, has accumulated loans throughout her undergraduate studies and plans on taking out additional loans for graduate school.

“I got accepted for a grant that will pay 100 percent of my tuition, but I still need money for books, gas, parking and anything else I need,” Aranas said. “I applied for financial aid and got offered loans from Wells Fargo, but just went with UTEP.”

As a single mother who receives a low income, Aranas was able to defer her loan repayments until she finishes with graduate school, but she said she remains nervous about how she will manage to pay for everything upon completion.

“I believe that (UTEP) should be able to help us with anything so as to avoid students pulling out so many loans,” Aranas said. “It would be a lot of help, especially to graduate students.”

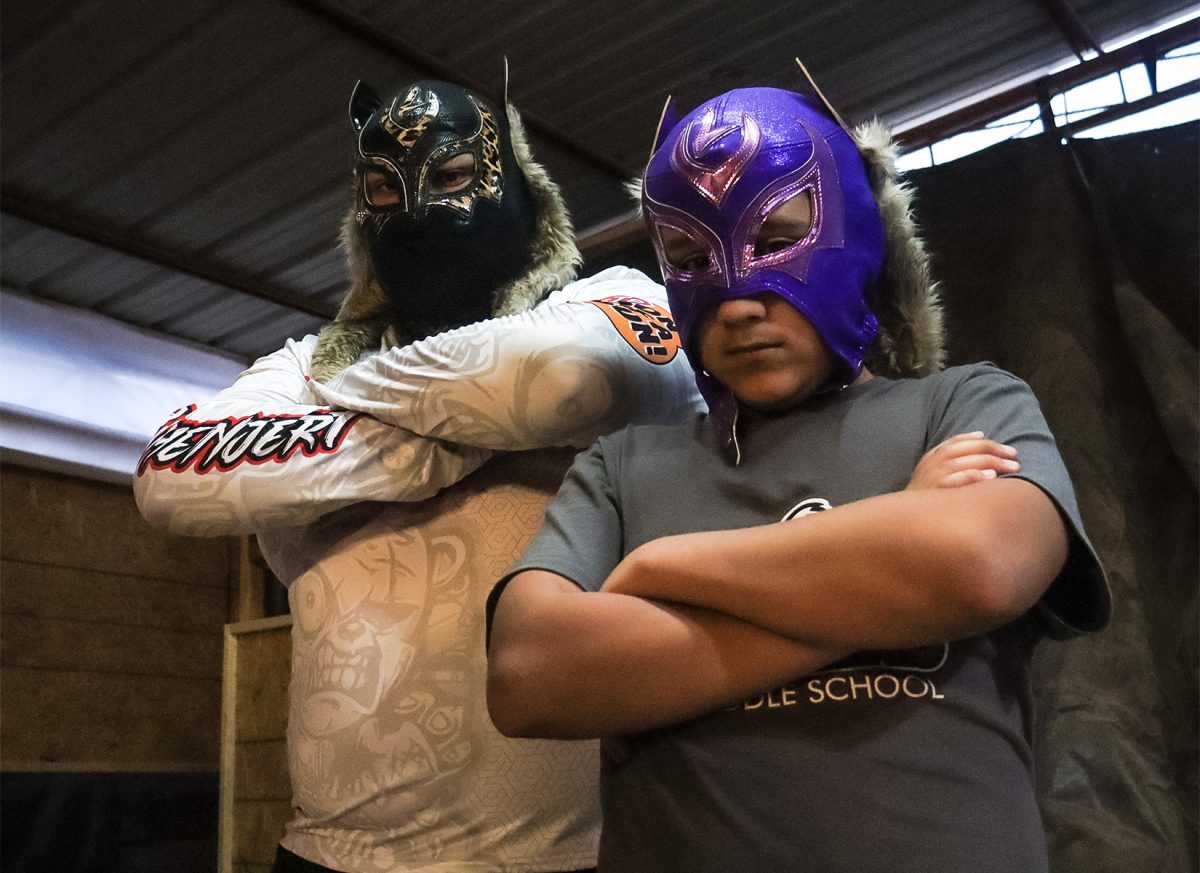

Roque Orozco, senior music major, knows he is in debt, but continues to use loans to help him pay for school. Contrary to Aranas, he welcomes them and is confident about paying them back.

“After (graduating), I’m going to work for a year, save up and pay in a combination of savings and loans,” Orozco said.

He plans on working in the public school system and hopes that teaching will provide the experience needed for graduate school and will begin to help pay for some of the loans.

“Yes, I am in debt, but (loans) helped me finish school. I should be able to pay it all within two years,” Orozco said. “I saw it as an investment in my future.”

Associate director of the University Career Center, Betsy Castro-Duarte, said she often speaks to students who may not be certain what the future may hold for them. She said the economy might be one of the main reasons students remain so hesitant to move on and grow.

“I think once they find their comfort level and develop a skill set, things come at a certain point,” Castro-Duarte said. “They want to be secure in their job and sometimes it takes them longer to find a job, which delays them getting married and delays them buying items like cars and houses.”

Padilla said he looks up to his brother for settling down after he landed his dream job and became a math teacher.

“I think it is important to achieve the goals one has for themselves,” he said. “It is okay to delay some of those grown-up experiences. I really look up to my oldest brother, he waited until he graduated college to get married, he became a math teacher and then got married, so I really look up to that and I think it is the best way to do things.”

Castro-Duarte said her best advice to students would be to never sell themselves short when it comes to competing for jobs after college.

“Whatever happens, your college degree is going to open up doors for you,” she said. “There is good debt and bad debt, tuition is a good investment because in the end your education still pays off.”

For more information about resources in paying back tuition and fees, visit sbs.utep.edu.

Lorain Watters and Amanda Guillen may be reached at [email protected].