Interest rates on federal student loans will increase only a fraction despite legislative inaction in early July and the threat of a dramatic increase.

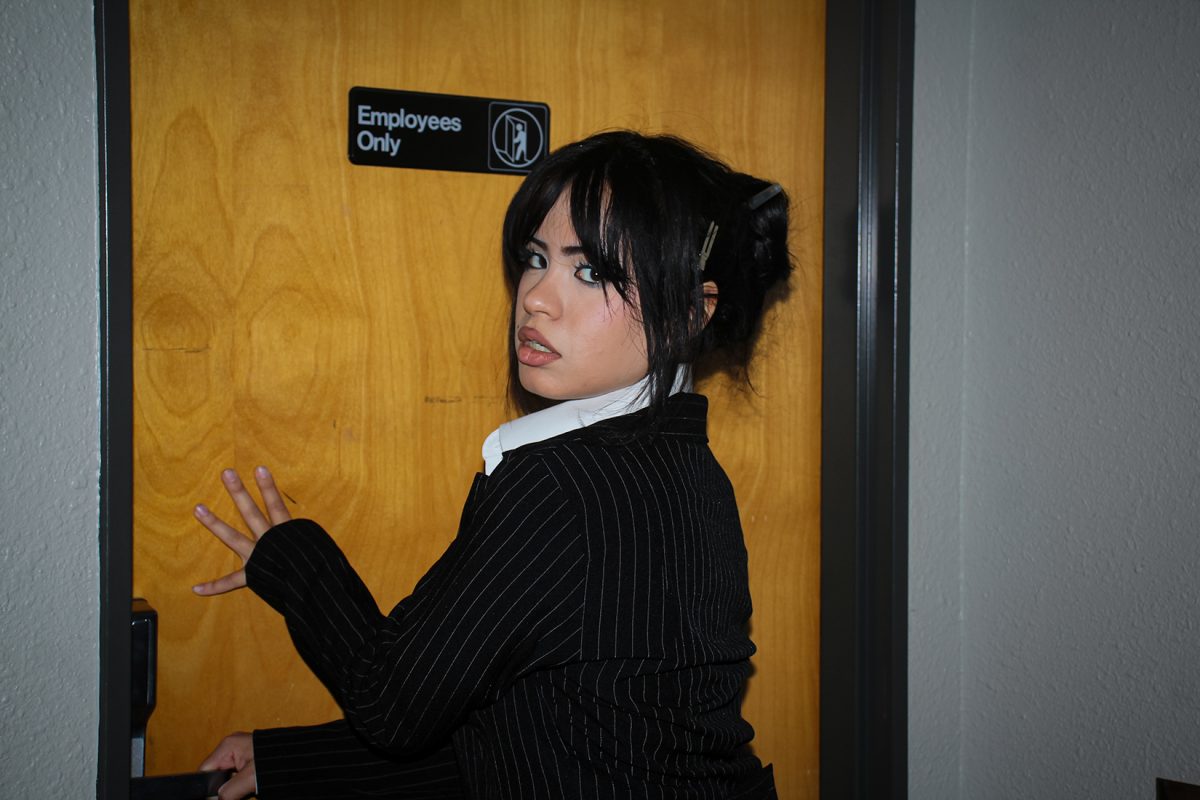

“Nobody’s comfortable paying for interest, but I’m just so glad it didn’t jump that much,” said Diego Romero, junior graphic design major. “It is something I always take into consideration whenever I’m taking out a loan.”

The newly signed Bipartisan Student Loan Certainty Act will increase the interest rate on Stafford loans from 3.4 to 3.86 percent, rather than the 6.8 percent Congress anticipated in June.

“They did end up tying that rate to the Treasury note (rates), but they put caps on the loans,” said Craig Westman, associate vice-president for student solutions and outcomes.

Treasury notes are a type of security bond that individuals can purchase from the federal government. Notes are bought at a specific price and interest rate, then mature two to 10 years later. As the bonds mature, they pay out to their owners. This way, citizens can invest and try to capitalize on the success of their own government.

The interest rates are usually announced for these securities in July. It is this announcement that will set the interest rate for educational loan disbursement.

According to the bill, undergraduate loan interest rates will mirror the announced interest rate plus an additional 2.05 percent, but future rates will not exceed 8.25 percent.

The legislation also aims to increase transparency within the Department of Education. The Secretary of Education will convene an advisory committee on Improving Postsecondary Education Data to study practices and techniques for improving educational transparency in the federal government.

Graduate students will experience higher rates on their loans at the base rate of the Treasury note plus an additional 3.6 percent. Interest rates for federal-subsidized graduate Stafford loans are capped at 9.5 percent.

Although a major increase was avoided, there is still the potential for higher rates. According to economic forecasting by the International Monetary Fund, global economies, including the U.S., have seen a subdued uptick in growth, which may ultimately increase the value of the Treasury notes.

“Being tied the way it is, those rates could go up for new borrowers next year,” Westman said. “We’ll have to keep an eye on that.”

The Treasury note’s value changes as the economy fluctuates. As economic situations improve, the value of those notes will have a related increase. If the interest rate hits its cap, UTEP students could expect to pay an additional $40 per month after graduation.

“It sounds good as long as the economy stays in a slump,” said Alex Arenivar, senior criminal justice major. “The economy may stay like this for a while, so it would be good in the short term.”

With the Department of Education reporting that student loans are now a trillion-dollar industry, the impact on a national scale could be significant.

Despite this, the new cohort of students coming in for the fall have expressed few concerns to financial aid staff, Westman said.

Westman said that a majority of the calls fielded by the admissions and financial aid offices were from concerned parents.

Students are not required to check their financial aid loan packages. The changes are automatically made by the government and then awarded by UTEP.

So far, there has not been a noticeable change in the number of students taking out loans for school. However, with interest rates fluctuating in the future, student trends in loan acceptance may change.

Institutional research has shown that UTEP students prefer to pay-as-they-go rather than taking on student loans.

“It is an investment in your future,” Westman said. “Take your loans, finish school, go out, get jobs.”

Students may contact the UTEP Office of Student Financial Aid at 915-747-5204 or by email at [email protected].

S. David Ramirez may be reached at [email protected].